Market Highlights

Alexandria Real Estate and Eli Lilly join forces to bring their co-working lab, gateway labs, to Durham with plans to launch the 62,000 SF facility in the first half of 2024.

ACON Laboratories secures 510(k) clearance for a rapid COVID-19 test that can be sold over the counter and subleases almost 100,000 SF of space from Thermo Fisher to close in 2023.

Drug discovery and biotechnology firms got almost half of the venture capital funding for Durham life sciences in the last quarter of 2023.

Major Developments Under Construction

Pacific Center

Pacific Center

- SF: 528,000

- Delivery: Q1 2024

- Will be developed over four phases

- Developer: Harrison Street

Aperture Delmar

Aperture Delmar

- SF: 500,000

- Purpose-built for Neurocrine Biosciences

- Delivery: Q4 2024

- Developer: Breakthrough Properties

RaDD

RaDD

- SF: 405,000

- The campus will total nearly 1.7 million square feet (msf)

- Delivery: Spring 2024

- Developer: IQHQ

Bioterra

Bioterra

- SF: 323,403

- One of the first ground-up lab projects in Sorrento Mesa

- Delivery: Q1 2024

- Developer: Longfellow Real Estate

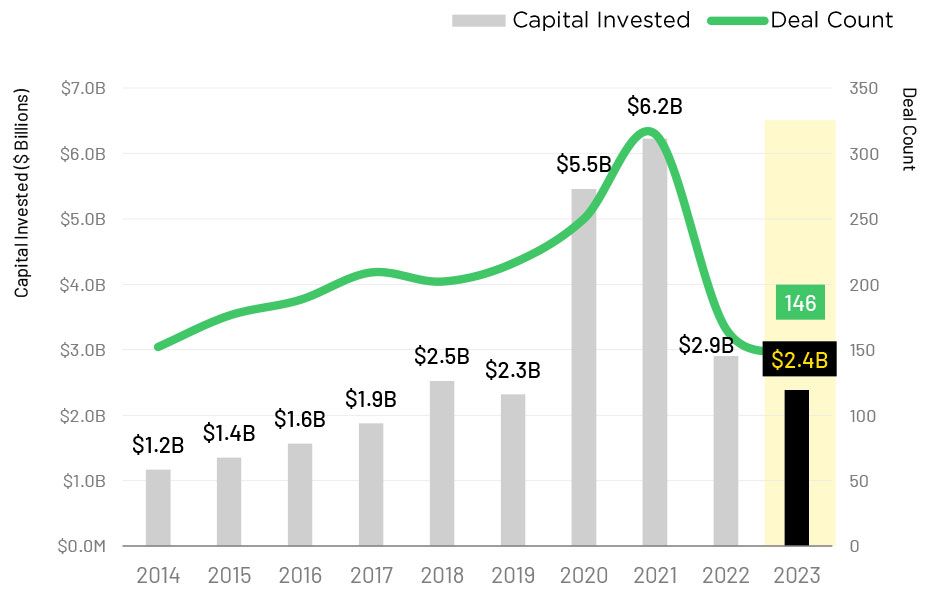

Life Sciences Related VS Funding

| Companies | Deal Size | Deal Type |

|---|---|---|

| Rakuten Medical | $182.1M | Later Stage VC |

| Iambic | $103.2M | Series B |

| Lassen Therapeutics | $85.0M | Series B |

| MBrace Therapeutics | $85.0M | Series B |

| Adcentrx Therapeutics | $51.0M | Series A |